Table of Contents

In today’s fast-paced financial landscape, having a stellar credit score is more important than ever. Whether you’re applying for a mortgage, leasing a car, or seeking the best insurance rates, your credit score can significantly impact your financial decisions. If you’re looking to improve your credit score, you’ve come to the right place. This 30-day credit makeover plan will guide you through simple, actionable steps to enhance your creditworthiness and help you achieve that coveted perfect score.

Understanding Credit Score Basics

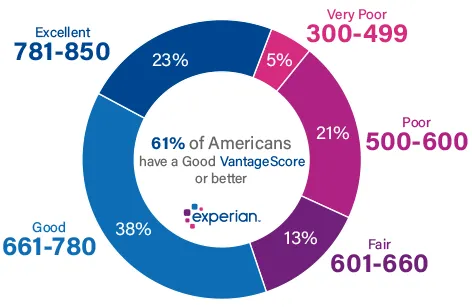

Alright, before we dive into the nitty-gritty of boosting your credit score, let’s break down the basics. So, what exactly is a credit score? Think of it as your financial report card, a number that ranges from 300 to 850. The higher your score, the better you look to lenders and financial institutions. But how do they come up with this magic number?

Two major models, FICO and VantageScore, dominate the scene. They look at a few key factors: your payment history, how much of your available credit you’re using, the length of your credit history, the variety of credit accounts you have, and any recent inquiries into your credit. Payment history and credit utilization carry the most weight, so keeping an eye on those can make a big difference.

Understanding these elements can help demystify the process and show you exactly where to focus your efforts. Once you get a handle on these basics, you’ll be in a much better position to start making moves toward that perfect score.

Identifying Credit Score Discrepancies

First things first, let’s tackle those pesky credit score discrepancies. Grab your free credit reports from Experian, TransUnion, and Equifax—yes, they’re free once a year by law. Now, dive into those reports like a detective on a mission. Look out for incorrect personal details, mystery accounts you’ve never heard of, or any payment history that looks off. These errors can unfairly drag down your score, and nobody needs that kind of negativity.

If you spot any issues, don’t panic. Each bureau has a straightforward dispute process, usually available online, that you can use to get things corrected. Make sure to provide any documentation that backs up your claim. The sooner you tackle these discrepancies, the sooner your credit score can start reflecting your true financial behavior.

And here’s a little pro tip: regularly monitoring your reports can help you catch errors early. Some credit monitoring services even offer alerts for any changes, giving you the heads-up before things get out of hand. By staying on top of this, you’re already one step closer to that perfect credit score you’re aiming for.

The Impact of Financial Decisions

Every swipe of your credit card, every bill paid—or unpaid—carries weight when it comes to your credit score. It’s like each financial move you make is a puzzle piece that fits into your overall credit picture. Miss a payment? That piece turns red, signaling trouble. Pay on time? That piece glows green, showing you’re on the right track.

Let’s chat about credit card balances. If you’re racking up charges and your balance is creeping close to your credit limit, that’s a red flag for credit bureaus. They call this “credit utilization,” and ideally, you want to keep that below 30% of your total available credit. This shows lenders you’re not living on the edge of your credit line.

Opening too many new accounts in a short span can also ding your score. It might seem like a good idea to grab that department store card for an instant discount, but those new account inquiries can add up and make you look desperate for credit. On the flip side, having a mix of credit types—like a credit card, a mortgage, and a car loan—can actually help your score because it shows you can manage different kinds of debt responsibly.

So, before you make your next financial move, consider how it fits into your credit puzzle. Being mindful of these factors can set you on the path to achieving that perfect score you’re aiming for.

The Independence of Credit Bureaus

Each credit bureau—Experian, TransUnion, and Equifax—operates independently, meaning they may have slightly different data about you. Picture each bureau as its own island, collecting and updating information at its own pace. Because of this independence, the reports they generate can vary. One might show an account that another misses, or reflect a payment differently.

You might wonder, “Why does this matter?” Well, when you apply for a loan, the lender might check just one of these bureaus, which can impact your chances of approval if the chosen report isn’t up-to-date or contains errors. This is why it’s so important to keep tabs on all three reports. Imagine if you’re getting ready to apply for a mortgage and one report shows a missed payment you know you made—talk about stress!

Here’s another thing to keep in mind: not all lenders and financial institutions report to all three bureaus. Some might only send updates to one or two. This means your stellar on-time payments could go unnoticed by one bureau, potentially leaving a blind spot in your credit profile.

So, how do you navigate this? Regularly check each report for discrepancies and make sure any errors are disputed promptly. Being proactive ensures that each bureau has the most accurate and up-to-date information about your credit history. This way, no matter which report a lender pulls, you’re putting your best financial foot forward.

Key Factors Influencing Your Credit Score

Let’s dig into what really moves the needle on your credit score. First up is your payment history—it’s the big cheese, making up about 35% of your score. Think of it as your track record for paying bills on time. Even one late payment can ding your score, so setting up automatic payments or reminders can be a game-changer.

Next, we’ve got credit utilization, which is about 30% of your score. This one’s all about how much credit you’re using compared to what’s available. Keep those balances low—ideally under 30% of your total credit limit—to show you’re not maxing out your cards.

Then there’s the length of your credit history, which accounts for 15%. The longer you’ve been using credit responsibly, the better. So, even if you’ve paid off old accounts, it can be smart to keep them open to maintain that long, healthy credit history.

Diverse types of credit make up about 10% of your score. Lenders like to see a mix—credit cards, mortgages, auto loans, you name it. It shows you can handle different kinds of debt. But don’t go opening new accounts just for the sake of variety; that can backfire.

Last but not least, those recent inquiries make up the final 10%. When you apply for new credit, it results in a “hard inquiry,” which can temporarily lower your score. So, think twice before signing up for that store credit card just to snag a one-time discount.

By focusing on these key factors, you’ll be well on your way to boosting your credit score and reaching your financial goals.

Choosing Financial Services Organizations

Alright, let’s talk about picking the right financial services organizations. This choice can really make a difference in your credit makeover journey. Ideally, you want to go with lenders who report to all three major credit bureaus—Experian, TransUnion, and Equifax. Why? Because a comprehensive credit profile can help you build a stronger, more accurate credit history.

Now, think about the terms and conditions that come with loans and credit products. It’s not just about getting approved; it’s about finding favorable terms that support your financial health. Look for options with low-interest rates, manageable repayment plans, and minimal fees. These factors can help you maintain a good payment history and keep your credit utilization low, both of which are crucial for a solid credit score.

Another thing to keep in mind is customer service. A good financial institution will have a support system in place to help you navigate any issues that might come up. Whether it’s a billing error or a question about your account, having a responsive and helpful team can make a world of difference.

Also, don’t forget about online reviews and word-of-mouth recommendations. Sometimes, the best insights come from people who have been in your shoes. So, take the time to research and choose financial services organizations that align with your goals and can offer the support you need.

The Role of Insurance Services

You might be surprised to learn that your credit score doesn’t just affect loans and credit cards; it also has a say in your insurance rates. Yup, many insurance companies peek at your credit score when deciding your premiums. It’s like they’re saying, “How financially responsible is this person?” So, a higher credit score can often lead to lower insurance costs, which is a win-win.

But how exactly does this work? Insurance companies use something called a credit-based insurance score, which is a bit different from your regular credit score but still relies on similar information. They believe that people with better credit scores are less likely to file claims. So, by boosting your credit score, you could potentially save some serious cash on your car or homeowner’s insurance.

Here’s a tip: some insurers weigh your credit score more heavily than others. It might be worth shopping around to find a company that either doesn’t use credit scores at all or puts less emphasis on them. That way, you can ensure you’re getting the best rates possible while you’re on your credit makeover journey. So, while you’re focusing on improving your credit score, keep an eye on those insurance premiums too. It’s all connected!

Monitoring Your Progress

Alright, so you’ve started your 30-day credit makeover—fantastic! But how do you know if all your hard work is paying off? That’s where monitoring your progress comes in. Think of it like checking your fitness tracker after a good run; it keeps you motivated and on track.

First off, take advantage of free online tools and resources that let you peek at your credit score anytime. Websites like Credit Karma or apps from your bank can give you regular updates. Some of these tools even send you alerts if there’s any significant change, so you’re never caught off guard.

Remember those credit reports you pulled earlier? It’s a good idea to review them periodically, especially if you’ve filed any disputes. Make sure the corrections are reflected in your reports.

Set some mini-goals along the way. Maybe it’s paying down a certain amount of debt or going a full month without a late payment. Celebrate these wins—they’re milestones on your journey to a perfect score.

And don’t forget to check how your changes are impacting your overall financial picture. Look for trends: Is your credit utilization going down? Are your on-time payments stacking up? Seeing positive trends will keep you pumped and focused on your end goal.

Conclusion

Congratulations, you’ve made it through the 30-day credit makeover! By now, you should have a clear understanding of the key factors that influence your credit score and the steps you can take to improve it. Remember, the goal isn’t just to reach a perfect score; it’s about maintaining healthy financial habits that will benefit you in the long run.

It’s important to stay proactive—keep monitoring your credit reports, stay on top of your payments, and manage your credit utilization wisely. Think of your credit score as a living, breathing thing that needs regular attention and care.

You’ve also learned that each financial decision, no matter how small, can have a ripple effect on your creditworthiness. So, continue to make informed choices when it comes to your finances, and don’t hesitate to seek out financial institutions that align with your goals.

Lastly, keep in mind the broader impact of your improved credit score, like potential savings on insurance premiums. It’s all interconnected, and the benefits extend beyond just loans and credit cards.

Stay diligent and keep those good habits going. A high credit score is not just a number; it’s a stepping stone to better financial opportunities and peace of mind. You’ve got this!